We are living in a digital world where we use cashless transactions daily. Some are from debit cards or online wallets and some are from credit cards. If you are a high expenditure person, it’s better to freeze your credit card to manage your expenses and use cash. Track your expenses with expense manager apps so that at the end of the month you can have a summary of your expenses. Liabilities are your burden try to reduce them as much as possible. Your eating habits play a huge role in your expenses. If you reduce eating outside it will save your pocket and health as well. Go through your utility bills and cut down the expenses that are not required. For a couple of months note down your expenses and then start making a budget and spending accordingly. Your income should be categorized with the 50:30:20 rule. Manage your Debts – The liabilities are always a burden on your pocket, try to avoid EMI’s and Credit Card if you can’t control your shopping habits. Initially, you buy, then it’s difficult to pay the full bill and you start EMI and fall into trap to pay more interest to the banks for the purchases that were not necessary.

The person who earns more is not rich but the person who saves become rich.

Your income is not stable so always try to limit your recurring expenses.

1. Record your transactions

Every day you are spending some amount on travel, food etc. Try to record them because all these daily small expenses are unrecorded. Record your monthly expenses such as electricity, internet, mobile recharge, milk, gas, online subscriptions and other expenses. Before managing your expenses, you should have data on your expenses so that you can plan to manage them wisely. You can simply install expense manager apps on your mobile which will record and categorize your expenses. Also, you can compare the monthly expenses at zero cost. You can buy premium apps also, but for now, let’s plan to save!

2. Make a Budget

Based on your recorded data analyse monthly or weekly expenses. Plan to reduce these recorded expenses. If online subscriptions are not useful you can simply unsubscribe them. If you think, you can reduce your electricity bill, work on it. Focus on your outside eating expenses. Initially, you can cut it to the lowest. It is good for your health as well as for your pocket. You can also opt for low cost internet plan to manage your expenses.

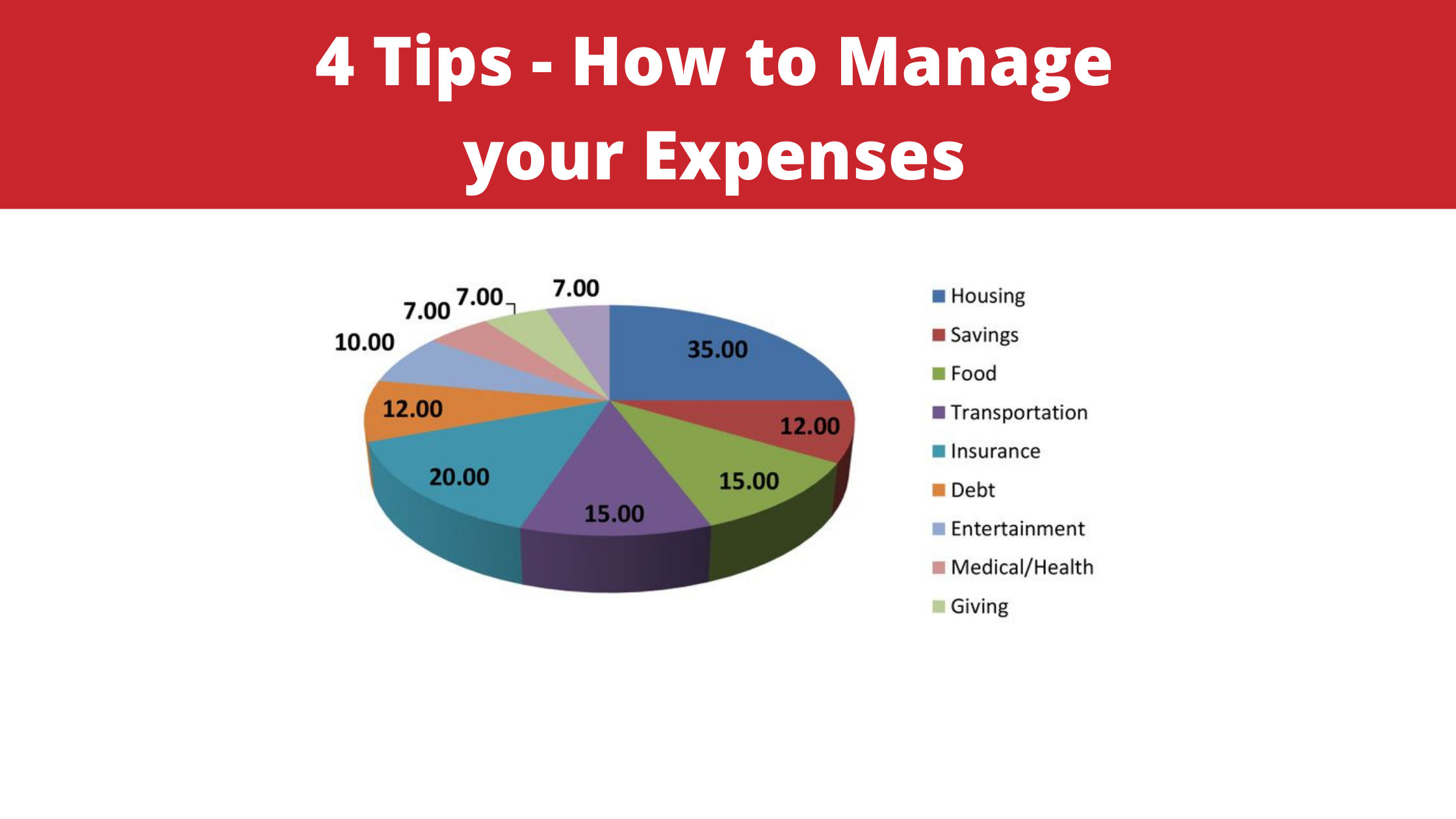

3. Follow 50:30:20 Rule

The rule is to manage your income and categorize it on your expenses. 50% of your monthly income is for monthly expenses such as bills, insurance, EMI’s etc. 30% is for your entertainment like movies and outings. 20% is saving for your future. Your income is unstable, but expenses are fixed. Always save monthly and the best option is through SIP’s and the SIP date for a salaried person should be just after the salary date. The less you see in your saving or salary account, the less you will spend. If your current salary is 30,000 your expenses will be according to 30,000. After increment, your salary hikes to 35,000 your expenses will be according to 35,000. Whatever is your income 20,000 or 50,000 your expenses will be according to that. So, increase SIPs as salary increases.

For Business Owners and self-employed people, start multiple SIPs of small amounts because there is no fixed date when you are excited to see your bank account balance.

4. Manage Online Purchases

Most people are moving to eCommerce websites for their online purchases. In an earlier time, if a person go for shopping in the market few things skips from mind. When you visit a shop limited options are available. On the other hand, with eCommerce stores you can have unlimited options so that many times we do unwanted shopping also. Online stores, allows you to shop anytime and anywhere which increases our shopping habits for unnecessary expenses. It’s true we get a lot of discounts but think before buying, do you need it?

To increase your buying habits, the eCommerce industry gives many new options such as EMI’s and pay later options. Also, with their amazing cross-selling techniques you increase a lot more than you required. To manage your expenses use a Shopping List and sticky buy accordingly to it for your needs, not for your wants.