Introduction of IRDA

IRDA means insurance regulatory and development authority. Insurance Regulatory and Development Authority of India (IRDA), it is the apex body overseeing the insurance business in India. IRDA set all rules and regulation of the insurance industry. Every insurance company is registered under IRDA. Role of Insurance Regulatory and Development Authority (IRDA) is to protect the rights of the policy holder. IRDA helps in the systematic growth of the insurance industry to benefit the common man and help in bringing economic growth.

What is IRDA Act?

What is IRDA Format for Insurance Industry?

Functions of IRDA:

- To protect the interest of policy holders

- To maintain speedy growth of the insurance industry

- To provide funds for the growth of the Indian economy

- To promote, monitor and regular fair dealing with the insurance company

- To manage the claim quickly and properly

- To prevent frauds & manage the grievance system properly

- To maintain transparency & fairness of insurance products in the industry

- To register the companies who run in the insurance business

Role of Insurance Regulatory and Development Authority (IRDA)

Role of Insurance Regulatory and Development Authority (IRDA) is to protect the interest of and ensure the treatment to insurance policy holders. To inspire the systematic growth of the insurance industry to benefit the common man and help in bringing economic growth.

Impact of Insurance Regulatory and Development Authority (IRDA)

- Impact over Regulation of Insurance Sector

- Impact over Policyholders Interests Protection

- Impact over Awareness to Insurance

- Impact over Insurance Market in India

- Impact over Development of Insurance Product

- Impact over Competition in the Insurance Sector

- Impact over Saving and Investment of Individual

- Impact over Government Responsibility

- Impact over Banks and Post Offices

- Impact over Individual Life’s

- Impact over Share Market

- Impact over Indian Economy

Effect of Insurance Regulatory and Development Authority (IRDA)

- The effect on the Regulation of Insurance Industry

- The effect over the protection of policyholders

- The effect of Awareness about Insurance policy

- The effect over Indian Insurance Market

- The effect over the Development of Insurance Product

- The effect on Competition between Private and Public sector

- The effect over Banks and Post Offices

Insurance Products in IRDA:

Insurance products offered by the insurers are of value to the policyholder and that their pricing is appropriate and fair between the insurer. There are various verities in Insurance according to the different needs. Now a day’s customer is analyzing and comparing the policies of various companies with one another and choosing the best among them. The insurance industry has a huge market to target. Insurance products act more as a protection tool than as a way to save tax. The main factor to compare insurance policy is Price, service, and products that differentiate one product from another. No Company can introduce a new product before taking prior approval from the Insurance Regulatory and Development Authority (IRDA).

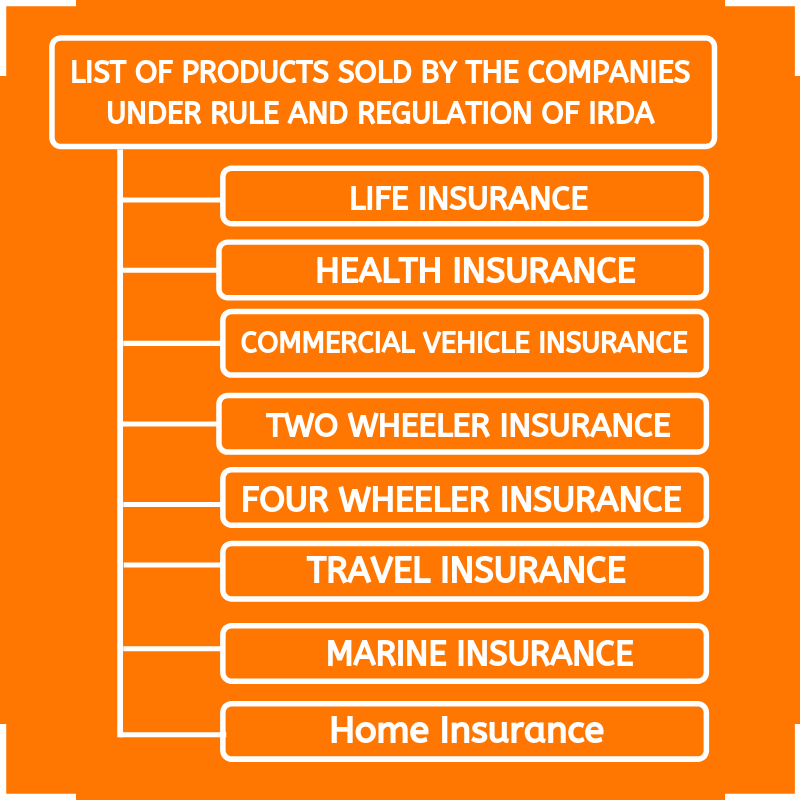

List of products sold by the companies under rule and regulations of IRDA

- Life Insurance

- Health Insurance

- Marine Insurance

- Two Wheeler Insurance

- Four Wheeler Insurance

- Commercial Vehicle Insurance

- Travel Insurance

- Home Insurance