What is Life Insurance?

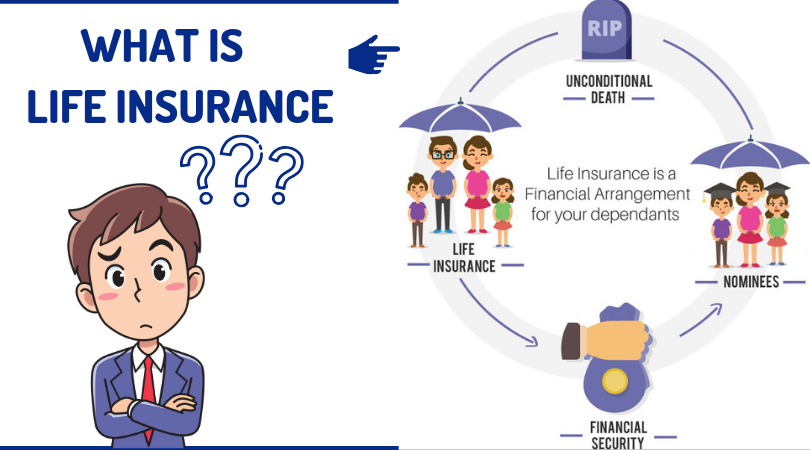

Life insurance is a term which simply says that this is insurance of your life. The major purpose of life insurance is to provide financial protection to your family or loved one after the death of the policyholder.

Under the term Life Insurance, there are different plans available along with their benefits. Some companies provide combo plans which mix two or three plans in one.

Types of Life Insurance Plans

- Term Plan

- Unit-linked insurance plan (ULIP)

- Endowment Plan

- Money Back

- Whole Life Insurance

- Child’s Plan

- Retirement Plan

Term Plan in Life Insurance

It is the basic plan where the policyholder can get financial protection for his family and loved once. The term plan works when the policyholder dies. The basic rule to understand what is life insurance is a term plan means life cover.

After the death of the policyholder, the nominee gets the Sum Assured (SA). The nominee can opt for different methods such as Lumpsum Amount, monthly paid outs etc.

You can add multiple riders on it which provides additional coverage to your policy. Like critical illness, accidental rider and much more. You can contact your Financial Consultant to know more about the riders available in Life Insurance.

Majorly, in this option, the policyholder doesn’t get any amount if he/she survives. But, now a day many companies provides the same plan in a different way. Under that, the company will return you the invested amount. The premium would be much higher as compared to the basic term plan but it depends on your decision.

Unit-linked insurance plan (ULIP) in Life Insurance

ULIP under Life Insurance plans provides you both i.e. life insurance and investment. You can invest in different types of funds such as equity, debts, hybrid, balanced etc. It depends on the plans that you have taken.

Endowment Plan in Life Insurance

It is also known as traditional plans. Endowment plans provide maturity along with the bonus that is declared periodically. This plan has a low investment risk.

Money Back in Life Insurance

This plan is for short term investors. Money back life Insurance plans provide life cover along with monthly or yearly return after a fixed period. Money back plan can help you to meet short term goals along with life cover. Sometimes bonuses are also declared in money back life insurance plan. Some companies offer a range of return along with previously declared bonus and some companies provide guarantee return along with life cover.

Whole Life Insurance

As per the name explains that under Whole Life Insurance Plan covers till the age of 100 years. In the case of term insurance there is a particular period of life cover, but in the case of whole life cover, there is no limit. It is like a guarantee in which the nominee will get the Sum Assured (SA).

The premium of Whole Life Insurance cover plan is higher because the company has to pay SA to the nominee and the chances of paying the SA is almost guaranteed.

List of Companies in Life Insurance

In India, there are many companies that are dealing in the life insurance sector. Such as HDFC Life Insurance Co. Ltd, Shriram Life Insurance Co. Ltd, Aviva Life Insurance Co. India Ltd, Bajaj Allianz Life Insurance Company Limited, Bharti AXA Life, Birla Sun Life Insurance Co. Ltd, Life Insurance Corporation of India (LIC), Max Life Insurance Co. Ltd, PNB MetLife India Insurance Co. Ltd, Reliance Life Insurance Co. Ltd, SBI Life Insurance Co. Ltd, Tata AIA Life Insurance Co. Ltd etc.

If you are choosing or life insurance for an investment purpose. You are probably on the wrong path. For investment, there are various other options available in the financial market like Fixed Deposits, Mutual Funds and more. Fixed Deposits, Mutual funds and more can give a better return depending upon the options that you opt for, but they don’t provide a life cover. You can call your Financial Advisor to help you to understand because everything is important.

Each financial product whether it is life insurance, health insurance, mutual funds, fixed deposits and other have their own importance and returns. In Health Insurance, You can invest for future emergency financial conditions. No doubt it provides the best return because just by paying 20,000-30,000 premium you get cover of 5 Lakh – 10 Lakh easily. But, in its own way. The focus of Health Insurance is to provide cover when you are hospitalized.

The concept of Life insurance is to provide cover for your loved one when you are not available for them. It provides financial security to them.

Mutual funds provide easy liquidity, Monthly investment plans and have a huge variety to choose from. Mutual funds are for growth and Tax saving. Coming to fixed deposits, it is for the investors who do not want to take any kind of risk in the financial sector. As compared to the young generation, fixed deposits are taken by senior citizens. Young generation focuses on Health Insurance, Life Insurance and Mutual Funds (SIP) Method.

All the financial instruments focus on their own Niche but provide additional benefits also. Life insurance is for the protection of life but also provides some return based on the plan. Health insurance is for hospitalization but provides additional returns like free health check-up, Regular doctor visits, Tax rebate etc.

Conclusion

The conclusion of this is like health insurance, fixed deposits and mutual funds; Life Insurance is also an importation financial product. You have to think about taking all the risk factors and protection of your family and loved once. You can add multiple riders on it which is a beneficial thing. You can add riders like: critical illness, additional Life, Monthly Income, Return on Investment etc. Apart from riders, you can choose various plans like Term plan, Lifetime Protection plans which cover till your last breath, Return on investment plans and much more.