Star Health Insurance: The Ultimate Guide (2019)

Star Health Insurance is a standalone health insurance company which deals in personal accidental insurance, overseas mediclaim policies, and general health insurance. It offers a wide range of products at affordable premium plans.

The company offers health insurance for individuals, family, senior citizen, diabetes patients, Cardiac Patients, OPD Policy, critical illness and more. It has more than 9100+ network hospitals in India. Started as a joint venture between ICICI Ventures Funds Management, M/s. Tata Capital Growth Fund, Oman Insurance Company, Sequoia Capital, Alpha TC Holdings Pte Ltd, it is the first standalone company approved by IRDA in India.

Here are some awards begged by Star Health and Allied Insurance Company limited:

- Most Promising Health Insurance Company at Healthcare Excellence Awards in 2014

- Claims Service Company of the Year at Indian Insurance Award in 2014

- Rated as the Best Claim Settlement Process Company by Hindustan MaRs Survey 2015

- Health Insurance Company Of The Year at Indian Insurance Awards 2015

If you are looking to buy a health insurance policy online, we recommend reading this guide before making any decision.

Types of Plans

Health

- Star Comprehensive Insurance Policy

- Family Health Optima Insurance Plan

- Medi Classic Insurance Policy (Individual)

- Senior Citizens Red Carpet Health Insurance Policy

- Super Surplus Insurance Policy

- Star Health Gain Insurance Policy

- Star Criticare Plus Insurance Policy

- Star Family Delite Insurance Policy

- Star Care Micro Insurance Policy

- Diabetes Safe Insurance Policy

- Star Cardiac Care Insurance Policy

- Star Cancer Care Gold (Pilot Product)

- Star Special Care

- Star Special Care

Accidental

- Accident Care Individual Insurance Policy

Overseas Travel

- Star Travel Protect Insurance Policy

- Star Student Travel Protect Insurance Policy

Benefits of Star Health Insurance

- • Cashless Treatment

• Extra Recharge Benefits of Rs. 1, 50, 000

• Restoration (up to 300%)

• Maternity Cover

• Lifetime Renewal

• OPD Cover

• Air Ambulance

• Free health check-up

• Daily Cash

• Additional cash on room sharing

• 9100+ Cashless Hospitals

• No Claim Bonus of 50%

• 25% Extra Sum Insured for Two Wheeler Accident

• Death Cover

• Star Health covers entry age up to 75years.

• Cardiac Patients Policy

• Diabetes Patients Policy.

• Cancer Patients Policy.

• Preferred hospital reward.

• Tax Rebate

Cashless Treatment

In cashless treatment the person doesn’t have to spend any amount during hospitalisation. He just has to show card to the TPA department to get the claim approved and afterwards the TPA department will get the claim directly from the health insurance company.

Extra Recharge Benefits of Rs. 1, 50, 000

According to this benefit star provides additional amount of Rs. 1, 50, 000 over and above the sum insured. The company will not card any additional amount for it. The amount will be available every year. The amount of Rs. 1, 50, 000 will depend upon the policy and Sum Insured.

Restoration (up to 300%)

Star Health Insurance Company provides restoration benefit up to 300%. According to restoration benefit the health insurance company will restore all the Sum Insured amount 100% x 3 times. The person must pay no extra premium for this. Sum Insured can be restored 3 times in a year. The restoration benefit of 300% will depend up on the policy you have purchased

Maternity Cover

The company, Star Health Insurance Company provides maternity cover. The amount and waiting period of cover may vary depending upon the policy you have taken.

Lifetime Renewal

In the Health Insurance industry most of the policies allow the entry age from 18 years to 65 years. Most of them charge extra premium or co pay after the age of 60 years. But entry age is 65 years. The person who has purchased the policy before 65years will enjoy the benefit of Life time renewal i.e. till the last breath. Star Health and Allied Insurance has separate policy for senior citizen which allows entry age up to 75 years with lifetime renewal benefit.

OPD Cover

The primary concept of health insurance is to provide financial coverage to the patient when she/he is hospitalised. Health insurance helps to bear the hospital expenses. For this, the person pays the premium every year. Now a days, health insurance also provides OPD Cover. Generally, under the period of Pre-Hospitalisation and post hospitalisation all the OPD, medicines and tests are covered. But, the OPD policy works without hospitalisation. Use get claim under the OPD policy the person must keep record of all the MBBS doctor visits and medicines bill. But submitting the documents and bill, the health insurance company will provide him all the claim amount. The person can take for any disease weather it is a normal cough and cold. Along with the OPD cover, the health insurance policy provides coverage for hospitalisation also.

Air Ambulance

The feature is used when somebody is in a case of urgency. In such a case air ambulance is used and Health Insurance Company will settle the claim of air ambulance also.

Free health check-up

According to this feature, the health insurance company provides free health check to the holder holder(s) after every claim free year. The amount of health check-up will depend on the sum insured. In PSU health insurance companies (Government health insurance companies) free health check-up is available after every 4 claim free years, but in case of private health insurance companies the free health check-up is available for every claim free year.

Daily Cash

This is a feature of health insurance Company under which the company will provide you daily cash for the time, the person is hospitalised. This doesn’t mean, the company will give you cash every day or hospital will collect amount from company and give cash to you ever day. According to this feature, the total amount of daily cash will be sent to you in your bank account. This feature has some capping and fix daily amount limit that will depend upon the policy and sum insured.

Additional cash on room sharing

In the list of some add-on features of health insurance companies, this is another great feature provided by the company. According to this feature, during hospitalisation the patient can choose single AC room of any amount but, if he goes for sharing room. The company will provide him some amount on daily bases for choosing shared room.

9100+ Cashless Hospitals

Star health and allied insurance company limited was the first standalone health insurance company that was started in 2006. As this is the first company, so it has the highest number of cashless hospitals tie up in India. Due to huge network tie-up the company has max. Number of cashless hospitals available in India.

No Claim Bonus of 50%

During claim free year, the health insurance company provides no claim bonus. The bonus is given for not raising any claim in last year. Under the feature of No Claim bonus which is popularly known as NCB will either increase the Su Insured or given discount on premium. In star health insurance company, the company given 50% No Claim bonus on every claim free year up to 2 times. Means, your health policy’s Sum Insured will be doubled in 2 claim free years. The amount of No Claim Bonus depends upon the policy you have opt. Star health and allied health insurance company has many policies. No claim amount varies according to the policy.

25% Extra Sum Insured for Two-Wheeler Accident

If the person is hospitalised due to two-wheeler accident and the hospitalised person is proposer the company will give additional 25% Sum Insured to the person for hospitalisation expenses. The person can use the additional sum insured in that event. This is just an add-on benefit that the health insurance company is providing to the insured during hospitalisation in case of two wheeler accident.

Death Cover

Under the list of additional benefits provided by the health insurance company, Star Health insurance company provides an additional benefit of death cover. According to the benefit, the person will get the Sum Insured amount in case of Death.

Star Health covers entry age up to 75years.

Most of the health insurance companies in the industry providing health insurance allows entry age up to the age of 65 years. The policy will go lifelong the entry age of buy the policy is restricted to 65 years in most policies. But Star Health and Allied Insurance Company Limited is available a special policy of senior citizen. The policy is available for individual as we as floater. A person can buy the policy till at the age of 75 years. The policy will continue lifelong.

Cardiac Patients Policy

While buying a policy there are few exclusions. According to that exclusion a person having no health policy initially, now buys a health insurance policy after having 1 heart attack is excluded. He is not allowed to buy a health insurance policy. But Star Health and Allied Insurance Company Limited has a special policy for the persons who have faced the problem of 1st heart attack. They can buy a special policy to get coverage for hospital expenses.

Diabetes Patients Policy

Persons who are taking medicines for diabetes are excluded from buy a health insurance policy in most of the cases. Diabetes is one of the root cause of other health issues. After diabetes chances of illness increases. That why the persons facing the diabetes issues are excluded from buying a fresh health insurance policy. But Star Health and Allied Insurance Company Limited has a special policy for the persons who are taking high doses of diabetes medicines. No other companies provide health protection in such cases. But, star health is available with most unique policies in the industry.

Cancer Patients Policy

The persons who are having cancer or have cancer in some stage of life which is not fully cured. The persons are also excluded from buy a fresh health insurance policy. The chances of claim after getting affected by cancer are higher so it is a point of exclusion. If a person was having a health policy before detecting cancer is totally safe from company side. All the major illness caused before buying a health policy a covered but buying a fresh policy after getting illness is a point of approvals and exclusions. But, lucky Star health and allied health insurance company provides a special policy for cancer patients. The person can get claim for all other diseases under the cancer policy.

Preferred hospital reward.

There are two types of hospitals. (1) Network Hospitals (2) Non-Network hospitals. These are the two major hospitals type under health insurance. In case of network hospitals, the cashless treatment is applicable and in case of Non Network Hospitals reimbursement is applicable. Under the major hospitals types there are some other hospitals types such as preferred hospitals, agreed hospitals and more. Preferred hospitals are the hospitals who has special tie up with the company for cashless treatment. Special tie up is a company’s part but if a person is hospitalised in a preferred hospitals. Star Health and Allied Insurance Company Limited will pay him Rs. 5000 reward for being admitted in a preferred hospital. The feature will depend upon the policy.

Tax Rebate

Tax Rebate u/s 80D of Income tax department. The annual amount that a person is earning is taxable. He is liable to pay income tax on all of his incomes. But, to save the tax there are some legal options available in the industry. The person can get tax rebate u/s 80C of Rs. 1, 50, 000 for showing is saving in different sectors such as mutual funds, life insurance etc. The person can get tax rebate of Rs. 55,000 u/s 80D. The propose can get tax rebate of Rs. 25000 on his health insurance policy and can get tax rebate of Rs. 30,000 for his dependent parents after the age of 60 Years.

Payment Options

To buy Star Health Policy you can do online payment, cheque or cash. All the payment options are accepted.

Latest Star Health Insurance Premium Chart

List of Hospitals Covered Under Star Health Insurance

https://www.starhealth.in/network-hospitals

How to File Star Health Insurance Claim

Cashless Claim Procedure

Family members should be aware of the empanelled hospitals.

There are be two scenarios of hospitalisation. Planned Hospitalised and Emergency Hospitalisation.

Planned Hospitalisation

In case of planned hospitalisation the proposer or his family member can call on

Toll Free Number 1800 425 5522

Non Toll-free: 044 28302200

For helpline before hospitalisation Toll Free Helpline Number: 1800 425 2255

Fax the Pre-Authorization form duly filled from the hospital. Hospital TPA can also do this as it is a department that handles cashless health insurance cases. Please carry a ID proof and your policy and ID card while hospitalisation.

Emergency Hospitalisation

In case of emergency hospitalisation like in case of accident or some other illness which is not planned requires emergency hospitalisation. This case requires imitate admission. If you visit cashless hospital you can follow these steps.

The family member can contact on Toll Free Helpline Number: 1800 425 2255

Fax the Pre-Authorization form duly filled from the hospital. Hospital TPA can also do this as it is a department that handles cashless health insurance cases. Please carry an ID proof and your policy and ID card while hospitalisation.

Toll Free Number 1800 425 5522

Non Toll-free: 044 28302200

Reimbursement Claim Procedure

When the treatment is done under a non-cashless hospital, all the expenses incurred while hospitalisation will be reimbursed. You can submitted the documents of pre hospitalisation and post hospitalisation also. You can call on 1800 425 2255 to know after how many days should you submit the documents. Pre hospitalisation and Post hospitalisation days depends upon the policy. Some policies have 30 & 60 day; some have 60 – 90 days and some have 15 – 30 days also. You should take the information in advance about the last date of submitting Pre Hospitalisation, in hospitalisation expenses and post hospitalisation expenses as after submitting the due date you can face difficulty in getting claim or it can reject too.

Documents required for Reimbursement

- Duly completed claim form (Intimation to toll-free number is mandatory before the form is filled).

- Original bills with the medicines prescribed by the doctor, receipts and discharge certificate from the hospital. All the medical reports and its receipts. You should keep a photocopy or a scan copy of all the documents before submitting it for reimbursement. In some cases the company ask for hospital stamping on each bill also.

- In case you have purchased the prescribed medicines from outside the hospital. Original bills from chemists are required.

- All investigation test reports and the receipts from a pathologist supported by the note from attending medical practitioner/ surgeon prescribing the test.

- Surgeon’s bills and receipt of the operation.

- Self-declaration/MLC/FIR in case of accident cases.

- Certificate of treating doctors.

- If less than 15 beds, provide hospital registration certificate.

Claim Process

For Cashless Hospitals

- Approach the insurance desk of the hospital. Also know at TPA Third Party Administrator.

- Show ID card for the verification of the person.

- A network hospital will verify the ID card and sent pre authorisation to the star health insurance company. After submitting you will get sms about the intimation.

- The company’s doctors will check the documents and the illness case and will approve for cashless treatment based on the terms and conditions.

- The company can also assign a person/doctor for you to make work easiler.

- The health insurance company will settle the claim process according to the terms and conditions with the hospital directly. All the payment and other formalities will be done by the hospital and he health insurance company directly.

For Non-Cashless Hospitals (Reimbursement)

- In cash of non-network hospitals the company will not provide cashless facility.

- The company can assign a person/doctor for you to help you in the process.

- While hospitalisation you have to pay all the medical expenses form your pocket and later you can get all the money in your bank. Star Health Insurance Company will reimbursement all the amount. You have to submit all the original bills, report and other document to get the claim amount.

- To get reimbursement claim intimation is mandatory and to submit the hospital original documents you can visit nearest star health insurance office you your health insurance agent will do this for you.

- The company will settle the claim according to the term and conditions.

How to Renew Star Health Insurance Policy Online

To renew your star health insurance policy online you can visit the below mentioned link

https://retail.starhealth.in/renewal

To renewal your star health insurance policy offline you can visit the nearest star health office or call your agent to collect the cheque / cash from you.

Usually there is grace period of 30 days but it is sticky advisable to avoid this because if in case a hospitalisation even arises the company will not give any claim. A part from it due to some other reasons you renewal can be rejected so it is advisable to renew you policy 30 days before the due date.

Contact Information and Customer Reviews

Email: support@starhealth.in

Toll Free Numbers: 1800-425-2255 / 1800-102-4477

Other Users: (044) – 2853 2060 / 2853 2030

Nearest Branch Locator: https://www.starhealth.in/locate-us

Why to Choose Star Health insurance?

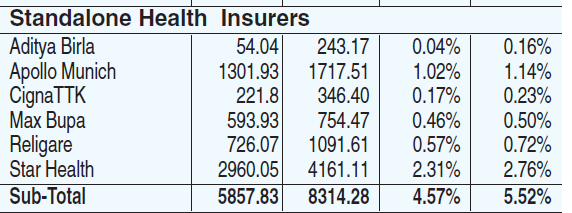

According to the IRDA Reports amount all the standalone companies Star health has railed maximum premium.

Total Premium 2015 – 2016; 2016 – 2017. Market Share 2015 – 2016; 2016 – 2017.

Total Premium 2016 – 2017; 2017 – 2018. Market Share 2016 – 2017; 2017 – 2018.

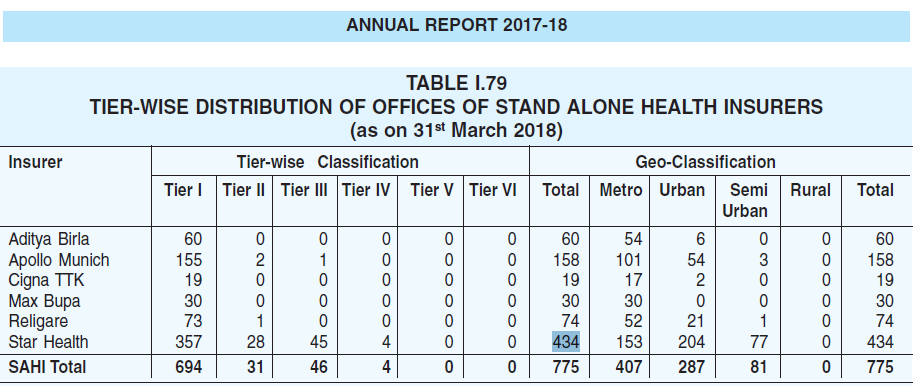

As per IRDA Data of Office of Stand Alone companies in India Star Health and Allied Insurance Company limited is having maximum offices in India. Total office in Geo-Classification as on 31st March 2018 is 434. Metro – 153, Urban – 204, Semi Urban 77.

The above data is based on the IRDA (Insurance Regulatory and Development Authority) report.